- What's it worth?

- How Dealers Use Price Guides

- Is Guide accurate?

- Certification

- Beware!

- Dealer's Credibility

"What's it worth?"

Without a doubt, that's the question most frequently asked about any coin with premium value as either a collectible or an investment.

The question sounds simple enough. Coming up with the right answer can be a lot more difficult unless you are dealing with a true expert who has peer respect for his pricing skills in specialized areas evidenced by being listed as a contributor in leading price guides. To make matters worse, coming up with the wrong answer - even doing so on purpose - isn't hard at all. All you need is a price guide with outdated values. And that includes the great majority of all the price guides available at any given time.

The accuracy - or inaccuracy - of price guides is a matter that should concern every collector who relies upon these authoritative-looking compilations. If the prices in a guide book or list are too low, collectors who depend on these resources could sell their coins too cheaply. If they're too high, collectors could end up paying too much when buying coins.

Honest dealers also can be hurt by inaccurate price guides. Collectors who rely upon such guides can wrongly conclude that competent, experienced dealers are cheating them - buying too low or selling too high - when their prices, though actually fair, deviate from those in the listings.

How Dealers Use Price Guides Determine Value

By definition, a guide is someone or something that provides information intended to help a person make an informed decision. The price guides used by coin buyers and sellers are lists of market values intended - in theory, at least - to help them decide how much to pay or how much to charge for given coins.

This would be a perfect way to determine the value of each and every coin if the prices listed in these guides were accurate to begin with and if coin values never went up or down. In the real world, of course, prices are in a state of constant flux and many of the values shown in guide books and listings in hobby periodicals are already inaccurate - sometimes by wide margins - before the publications even go to press.

Highly-respected coin dealers are honest and try to give their customers fair value by using the most up-to-date price guides available to them, plus the best information available to them from other sources, including auctions, fellow dealers and multiple dealer electronic trading networks. They are best suited to do this for the customer in the areas they specialize or make markets in. But even the best intentions can be undermined by fast-moving market developments that only the most connected market making dealer can keep up with. Meanwhile, dealers with the worst intentions view this situation not as a concern, but rather as a golden opportunity to buy very low or sell very high.

Even The Most Current Coin Price Guides May Not Be Absolutely Accurate

The unpredictability of market values has been dramatized in recent years by the frequent ups and downs of precious metal prices. Gold, silver and platinum all have trended significantly higher in long-range terms - but all have experienced corrections that have caused their bullion value, and that of bullion-sensitive coins struck from these metals, to fall sharply in the short run. Similar changes can, and have, also occurred over the years with numismatic coins - those whose value is based more on their collectibility.

Price guide publishers generally strive to be as accurate as possible. But the time lag between the preparation of these guides and their publication and distribution can be a matter of weeks - even months. Indeed, the valuations in the best-known guide book - the perennially best-selling "Red Book" - are "updated" months before the release of each annual edition. Yet, for marketing purposes, the cover date of each edition is advanced to suggest that the prices are not only timely but somehow ahead of the curve. Thus, the current Red Book contains valuations compiled in the prior year. This extends its shelf life at bookstores by making it seem more timely than it is, but there's nothing such tricks of the trade can do to keep the values fresh, especially for more volatile coins, which often include the most valuable ones. The "Red Book" even states "the coin market is so active in some categories that values can easily change during that period." One tip for determining freshness of a guide is to look for the precious metals prices and compare them to current prices.

Because they are published more frequently, newspapers and magazines can update their lists of market valuations more often than annual books and presumably keep them more accurate. But price guide sections of hobby periodicals still must be compiled weeks or even months prior to the date the publications reach their readers. Thus, they're unlikely to reflect significant market adjustments - what might occur, for instance, with gold and silver-sensitive coins if precious metals surge or plummet in value. And since a comprehensive guide might include upwards of 10,000 separate valuations, the logistics of regular updates can be daunting for the limited staffs of the major coin periodicals and websites. I have seen needed price changes take up to twelve months to be implemented.

Lag time and logistics aside, errors are bound to occur in the compilation of even the most carefully researched price guide. Recently, for instance, one monthly price guide showed the 1904 Liberty double eagle - the most common "Lib $20" in the entire series - worth 40 percent more in Mint State-63 condition than scarcer dates in the same MS-63 grade. The editor responsible for this price guide was notified of the mistake, but many months were likely to pass before the corrected value would reach readers. In the meantime people using this guide might easily make a disadvantageous buying or selling decision based upon the incorrect information.

Granted, this example was an isolated case. On the whole, price guides can be useful in at least establishing the relative values of different coins within a particular group or given series - in showing which $5 Indians are most valuable and rarer for instance than the most common 1909-D. But collectors should be aware that most of the prices shown in these guides pertain to typical specimens and are apt to be too low - or too high - for coins that are among the best, or worst, examples in their grade level. Also, they should keep in mind that mint state and proof coins generally require third-party certification in the current marketplace, and reputable price guides almost always provide valuations for these coins based on grades assigned by either PCGS or NGC. Typically, coins graded by lesser services are discounted in the marketplace - sometimes heavily - because they are less accurate and less acceptable to experienced buyers and sellers.

Choose Your Coin Certification Service Wisely

It's also wise to shun cold calling, mail-order or Internet coin dealers who distribute price guides but then deliver coins graded by substandard certification services without an FTC recommended 15 day return privilege. The Federal Trade Commission has cautioned that some certification services have looser grading standards than the industry norm and warned that coins sold by dishonest coin dealers too often are graded by such companies as "part of fraudulent sales schemes...intended to mislead consumers." Remember price guide prices are typically for PCGS or NGC graded coins and not for grading services whose similar sounding initials could be confused with PCGS or NGC. Have your dealer repeat each grading service's letters one by one.

The selling price of a coin also can vary substantially according to the circumstances of its sale. For instance, a coin in the same grade as another similar coin sometimes brings an unusually high price when sold at public auction, where two or more bidders intent on acquiring it can drive up the gavel price well beyond the pre-sale estimates. It could also sell for a low amount at a poorly attended or publicized auction. On the other hand, coins typical for the grade sold in knowledgeable dealer-to-dealer transactions are likely to change hands for more reliable amounts.

But even coins of the same date and grade can trade for higher or lower values between knowledgeable dealers based on a number of eye appeal factors including luster and strike.

Sometimes a buyer will need a particular coin graded by a particular grading service and will pay a premium for that.

Beware The Dealer Who Bad Mouths Other Dealers

Collectors should be particularly wary of coin dealers who bad-mouth the coin market in general or other dealers in particular. Frequently, such dealers have serious deficiencies themselves and are criticizing competitors to deflect attention from their own shortcomings - quite possibly including misleading use of price guides. In cases such as this, would-be buyers should apply the "Missouri test." Missouri is known as the "Show-Me State" because people who live there are skeptical of claims until they see supporting evidence. When one dealer bad-mouths another, both should be asked to show their credentials and substantiate any claims they may be making.

Confirming A Coin Dealer's Credibility

Here are some examples of evidence consumers should be seeking:

Professional affiliations:

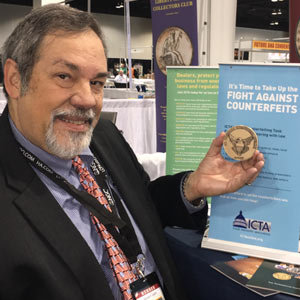

Are the dealers members of ICTA and are they authorized dealers for PCGS or NGC?

Business associations:

Are they members of the Better Business Bureau and other organizations that protect consumers' interests, and do they pledge to submit to arbitration provided by the organization when disputes arise?

Industry awards and citations:

Have they received recognition from their peers in the coin industry - nationally, regionally or locally - for their service, reliability and support of programs that benefit numismatics?

Leadership in the industry:

Do they hold leadership positions in any coin organizations nationally, regionally or locally?

Community service:

Do they actively participate in programs that serve their local communities, through financial support or personal involvement, and have they received recognition for such service?

Length of service:

Have they been in business and served the needs of their customers and communities long enough to establish meaningful reputations?

Government cooperation:

If required, are they licensed in their state to do business on the telephone? Do any governmental entities utilize the dealer as a consulting expert?